The 'Trifecta' of regulatory agencies has missed one thing: front-office bankers are working in a savagely competitive environment founded on a hierarchy that breeds the desire to cheat.

Yesterday’s regulatory announcements of fines totalling $3.3 billion for five large banks in connection with benchmark manipulation bring the Forex Fixing investigations to a close. Although more litigation is possible and banks have earmarked several more billion towards future penalties, the FX fixing case is now deemed concluded much like the Libor case not too long ago.

Without going into all the minutiae, the bottom line is that regulators from across the globe have combined their efforts and after lengthy investigations, have concluded that it was mostly misconduct amongst “individuals”, overseen by “inadequate internal controls” and broadly soft compliance measures.

Without going into all the minutiae, the bottom line is that regulators from across the globe have combined their efforts and after lengthy investigations, have concluded that it was mostly misconduct amongst “individuals”, overseen by “inadequate internal controls” and broadly soft compliance measures. In what may seem like an extensive investigation with published chat room conversations included, the possibility that FX manipulation went further than benchmarks or that many more people were involved was not even considered let alone established. The synchronised announcements yesterday were quickly followed up by a concerto of bank PR campaigns on damage limitation duty.

Banks are desperate to put a line under all the rigging revelations so for the sake of making someone accountable; 11 individuals are being investigated at UBS with 50 staff excluded from the bonus pool at RBS. Other banks have also provided a trickle of fall guys. It's also worth noting that dozens of suspended traders that worked for the penalised banks are expected to return, working under stricter oversight measures, to be sure.

Libor Lessons, Nothing Learnt

The deterrent impact of Libor penalties seems to have been limited, if not non-existent. The same with admitted (and penalised) mortgage rate fixing and ISDAfix manipulation. Case after case of rigging and malpractice has sprouted at the same banks for years and yet more cases follow. The regulators are either not effective enough or the bankers are too effective.

The magnitude of the fines is also pretty derogatory. Compared to the benefits generated and the banks’ overall size, the fines are puny, to say the least. As part of the FINMA announcement yesterday, the regulator admitted precious metals manipulation activities occurred at the same banks alongside the acknowledged FX rigging. Whether or not that will be investigated is unclear.

The regulators stack up fines and even taken in aggregate with all possible future litigation included, the penalties do not have a material impact on the banks. If the penalties were made truly severe in the $100-$200 billion range per bank or a blanket ban on dealing in particular securities, perhaps banks would notice.

The sad thing is that the more authorities penalise banks, the more they will have to bail them out if those penalties actually lead to significant losses. The banks are so systemically important that regulators are hesitant to unleash punitive measures for fear of blow-back onto the very economy(ies) they are instructed to safeguard.

A Cultural Oligopoly

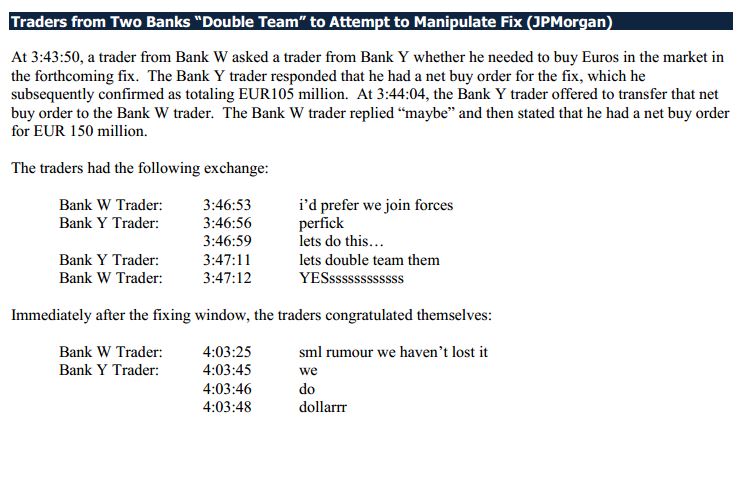

The chat room messages indicate a very clique, oligopolistic structure not only on the macro level with 6 banks controlling close to 70% of all FX volume but also on a personal level where 6-10 traders see themselves as groups that “protects itself” from perceived threats. They too try to control their market but on a micro level as a microcosm of how companies oligipolise and control whole sectors and industries.

The FX fixing generated profit so that Senior Management was happy with the traders doing the actual execution. Those senior managers have their own set of cliques and oligopolies with the same incentivisation structure applying up the chain of command.

The workings of an investment bank are such that something extraordinarily illegal could be occurring and witnessed by dozens of people but because of the clique arrangement, those activities are accepted as routine and part of normal business procedure in the hunt for market opportunities. FX fixing occurred without it even being considered fixing. It was just doing business.

It seems the traders engaged in the manipulation were doing their best to give their bank (and themselves in their corresponding clique) the best competitive advantage possible. The prevailing mindset amongst front-line traders is that of being on a war footing. Anything goes as long as it delivers results.

So while regulators fumble around with pesky fines quickly followed by new guidelines and compliance measures framing the problem as collusive misconduct, a much larger core issue is ignored. The root issue of front-office bankers working in a savagely competitive environment founded on a performance-ranked hierarchy that breeds the desire to cheat. Performance can be measured in many ways as the chat room chats prove.

In similar fashion to the Jerome Kevriel (Societe Generale), Kweku Adoboli (UBS) and Bruno Iksil (JP Morgan) cases where huge losses were attributed to either one or a small group of people, the FX case is following suit. Mr Kevriel even penned a book titled ‘Downward Spiral: Memoirs of a Trader’ in 2010, explaining in great detail how the ‘yes-man’ culture at his bank SocGen ensured malpractice was not only rife but actively encouraged to boost performance.

The underlying theme of Mr Kevriel’s claims is that all established investment banks operate within a culture where the end justifies the means. When market conditions get tougher, those ends get further away and require greater means to achieve. It’s just business after all.

Incentives and Dis-incentives

What possible incentive does an interbank G10 FX benchmark trader have to raise a compliance flag when such activity was widespread, commonly accepted and even bragged about? From the trader’s perspective, it would be a much safer ‘trade’ to go long on being quiet rather than long on whistleblowing.

On one hand, is the prospect of vibrant camaraderie with the opportunity to be part of a successful team that generates lucrative results whilst beating “mates” at other organisations. On the other is the prospect of being labelled a snitch, leaving his position, filling out regulatory forms, unlikely to be employed at another bank – although there is the silver lining of the warm and fuzzy feeling of doing the ‘right thing’ or so it is hoped by regulators at least.

From the published conversations, it appears that in the eyes of the traders, the ‘right’ thing is to not to worry so much about external idealisms of legal or illegal and instead focus on personal security and progression (which is directly linked to how you perform for the bank).

The traders would refer to themselves variously as “One Team, One Dream” and “a Co-operative”, the “A-Team”, and “The Three Musketeers”.

The collusive culture ensures the ‘team’ and ‘mates’ are valued above all else – including regulatory guidelines and boundaries. As the Libor and other fixing cases have proved, a veil of duplicity exists at banks whereby flagrant activity can go on in plain view all year round with behaviour changing only when regulatory action begins.

On top of that is the long tangle of various communications to ascertain who knew what, and when. Very tiresome when banks employ so many but the crimes are committed by so few.

In every case of alleged wrongdoing at banks, Senior management figures who took credit for the spicy earnings results over the past 10 years distance themselves from involvement with the bank as a corporate entity protected first and foremost.

Shareholders care not who sails the ship, but only that it reaches port.

Commissioned by Finance Magnates

Written by George Tchetvertakov